So, let's explore together why we raised the issue of Collection in travel.

Let's consider the following figures:

Flight service:

- Ticket cost: 560 EUR

- Agency mark-up: 25 EUR

- Cost of sales for the ticket: ~ 15 EUR

- Profit before taxes: 10 EUR

-

If the customer needs to be credited for 2 months with an average interest rate of 2% it means an additional cost of sale of : 11.2 EUR

This translates into the following calculation:

- Ticket cost: 560 EUR

- Agency mark-up: 25 EUR

- Cost of sales for tickets: ~ 15 EUR

- Additional cost of sales for crediting: ~11.2 EUR

- Profit before taxes: -1.2 EUR (actually a loss)

*Note: This example is a simple theoretical one, just to exemplify the previous statement. Reality is more complex than that and it depends on multiple factors: economy, interest rate, sales channel, conversion rate, technology used etc.

Another situation where the cost of sales can be greatly increased is the following: due to various reasons, the customer rejects the invoice and it needs to be rebuilt, which can become a costly process sometimes and that can add important delays.

There are many things that can be done in order to keep this under control. Financial strategies, better flow of money, etc. Nevertheless, in order to take a decision you need information and this is where our solutions come along within the picture.

In order to control the collection process, dcs plus is employing multiple tools in TINA, in order to allow the financial controller to do the following:

- Identify the problem and even the dimension of it

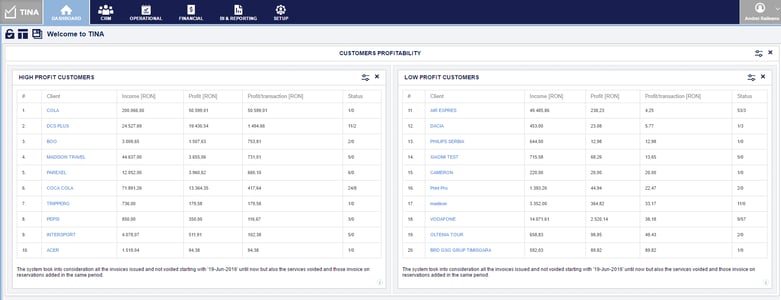

- Dashboard reporting

* customer names used are fictional

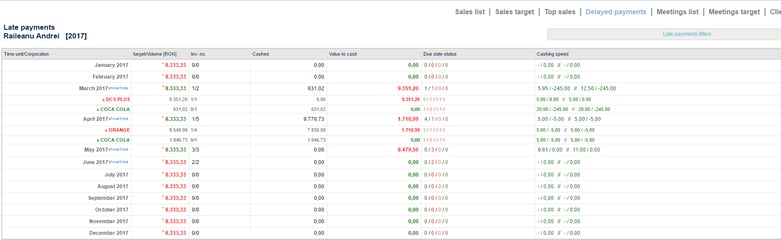

b. Customer payment behavior analytics

2. Take preemptive and corrective measures

- Credit limit

Allows the definition of credit limits for each customer or for customers segments, in order to control the dimension of the collection problem. There are two limits that can be set:

ALERT LIMIT: close to reaching the credit limit, internal and/or external notifications can be sent automatically to the key account manager or financial controller as well as the customer, notifying that they are approaching their credit limit in terms of unpaid invoices

ACTUAL CREDIT LIMIT: all sales are stopped until the situation is solved, either by payment of overdue invoices or increase of the credit limit

Multiple email templates can be created in order to use different approaches depending on the customer segment or customer type.

b. Collection reminders

Based on the settings, TINA will automatically send collection reminder emails to the financial responsible person within the customer's financial department. Various email templates and frequencies can be defined in order to allow a personalized approach for each customer or customer segment.

c. Customer profiles

By using the customer profiles in TINA, the travel agency can take multiple preemptive measures in order to control the collection process. Here are only few:

- Define clear service fees and discounts in order to make sure they are respected and the invoice is not rejected

- Define the invoice layout and content in order to ensure consistency in all invoices in order to avoid rejection from the customer

- Define the contact persons in order to make sure the invoice reaches the right one in due time

- Define the invoicing policy (invoicing date, payment due dates, etc.)

d. Quality Control

By using the quality control mechanism in TINA, the travel agency can ensure the quality of the invoice is always the same in order not to be rejected by the customer. Rules can be setup in order to make sure everything is perfect when the invoice leaves the travel agency.

e. Customer invoice export

Some large customers require the invoice in a certain format or as a preemptive measure, the travel agency can propose this to the customer, as TINA is perfectly capable of exporting data in various formats (csv and excel annexes, SAP annex, e-Invoice, etc.).

f. Aggregator reports

In case the customer is paying with a specific type of credit card (like Airplus for example), TINA is able to automatically prepare the necessary reports and deliver them to the Aggregator’s platform in order to ensure duly collection. If the agency needs to collect commission from hotels (for example) and is using a commission collection partner, the proper reporting and re-conciliation procedure is a must and TINA is perfectly capable of achieving that.

g. Automation of processes

We have almost disregarded one of the most common cause for missing proper collection: the human factor. How to make sure all that needs to be invoiced is invoiced in due time? With TINA it's easy. It involves two mechanisms:

- Automated process: allows for the definition of automated invoicing which, combined with all of the above features greatly reduce the risk of not invoicing some services

- Automated re-conciliation: enables the travel agency to double check if something is missing, as the supplier invoice should match the customer invoiced services. Having this process done automatically reduces the necessary check-up time from days (sometimes) to a couple of minutes or hours at most.

3. Monitor the outcome

Reporting - Once the proper measures are in place, the TINA Reporting platform allows the financial controllers to define new reports, which help monitor the outcome of the above measures. This reports can be setup to run automatically - so, no extra effort is necessary.

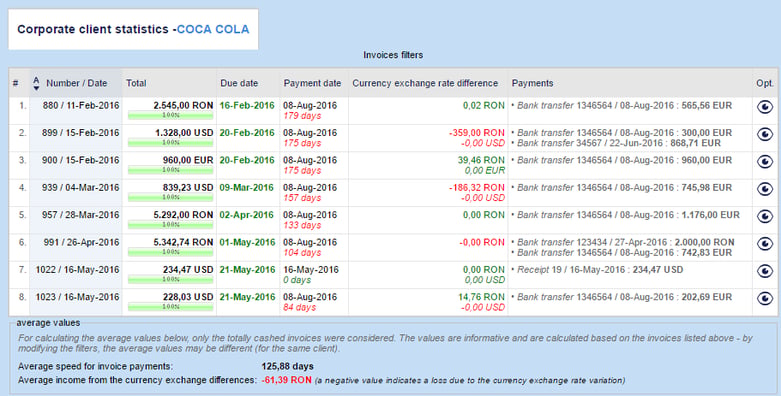

4. Easily report to management

One click away analysis - assuming that all the proper measures are in place but problems persists, is time to take the business case to higher management in order to determine what to do with such situations. Why spend hours or days to collect data, when TINA allows the data to be extracted in one click?